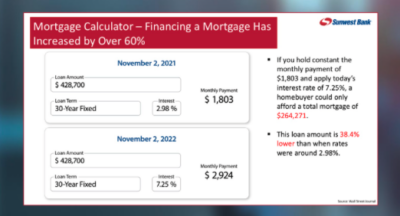

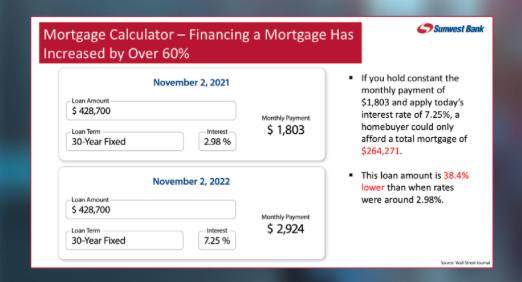

At the Sunwest Bank Economic Forum in November, the CEO talked about the effect of interest rates on the mortgage market. Basically, he said that it’s just math. Rising interest rates have crushed demand for loans and it’s going to have a negative impact on the housing market.

When rates peaked at 7.25% that meant buyer’s buying power was reduced over 38% compared to a year prior.

In other words, home prices have to come down 38% from their highs in order to maintain the same mortgage payment for buyers. Is that a collapse? I don’t think so because the entire real estate system is still functional and only housing prices are dropping. In 2007- 2008 the entire mortgage market imploded. We are not there, yet.

So where are home prices going in 2023? If rates stay in the 6%s like they are now, they will continue to come down from the highs we saw early this year.

If the economy goes into the predicted recession, job losses mount, and inflation continues to rise, then we could be in for even worsening home values.

How can I be certain? It’s just math!

It would be great if mortgage rates dropped into the low 5%s or the high 4%s. I think that’s where they need to be in order for buyers to get back into the buying mood.