Housing Market 2007 vs 2022

2007

The 2007 housing market was supported by 3 major pillars and the majority of the weight was on the pillar of Easy Money as the market consisted of these types of buyers:

- First Time Buyers (Little/No $ Down)

- Investors

- Traditional Buyers/Sellers

The majority of the loans were Subprime/Non-QM (Loans that don’t need to qualify with standard regulations), causing severe issues by allowing people being able to purchase homes they could not actually qualify for.

2022

Alternatively, the 2022 housing market is not nearly the same. There is a drastic difference in the ability to access easy money as well as much stricter regulations in the loan qualifications. The majority of the weight in 2022 is falling on the pillar of economic pressure.

- Higher Interest Rates

- Mortgage

- Consumer

- Highest Gas Prices Ever

- Inflation

Economic inflation has caused people to not spend as much as they have in the past. The result has caused the housing market to undertake the weight of the looming recession and added personal debt. Another factor to take into consideration is that the higher rates have disqualified many buyers from being able to afford and thus purchase a home.

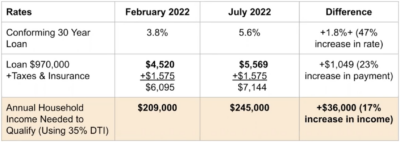

Conforming Loan Amounts v. Payments at Varying Rates

June 2022 Average Sales Price = $1,315,000

With Approx. 26% Down Payment the Loan Amount Would be $970,000

Approx. 15% of Orange County Households Can Afford the OLD prices at NEW Rates

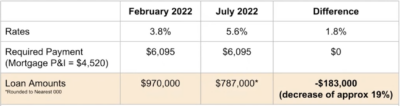

No Raise? Then What Can You Afford?

In order for a buyer to purchase the same priced home with a higher rate, they needed to have an increase in income of nearly 17% since the beginning of February.

The solution for many people who wish to purchase a home would be to borrow less than you would have in the previous months or years.

What Can Stop Home Prices From Falling?

- Mortgage Rates can continue to drop

- Natural Competition

- Subsidized by Government

- Program to help homeowners by paying interest for certain amount of time

- Government buys the Loans again

- Increase Maximum Qualifying Ratios

- Low Inventory

- Reverse Inflation

The government does not want the market to crash. As a preventative they are able to leverage all these options above to allow for home prices to remain consistent and keep the market from crashing unhealthily.

When Will Home Prices Stabilize?

- Prices Drop 15-20% OR

- Rates Drop into Low 4% Range Again

- Household Income Increases

- Buyers Get Used to Higher Rates

- Inflation Gets Under Control

- Lower Gas Prices

- Lower Grocery Bills

- Lower Utility Bills

- Government Action can be Taken

Why Buy Now?

- Rent is THROWING money away and going UP

- Trading Equities (Sell current home to buy another with less competition)

- Dream Home Available (Location, Location, Location)

- School & Other Specific Goals/Needs

- Loans are Available

- Timing the Market vs Time in the Market (the longer you are in the market, the less risk you will incur)

Conclusion

- The market is not the same as 2007

- Rates have caused many people to no longer be able to afford the purchase of a house

- There are many reasons why now is still a good time to purchase and sell in the real estate market.

- Contact me today and I’d love to have a discussion with you about your real estate goals!