Housing Crisis…do we have one?

I own both a mortgage company and a real estate company. My main markets are Southern California and Middle Tennessee.

Right now we are seeing record low sales caused by a number of factors but the biggest factor is the amazingly low, once-in-a-lifetime interest rates snatched up by homeowners and home buyers during the pandemic.

As I talk with homeowners about selling, the number one reason I’m given is that they are not going to give up their low interest rates.

So here we are with very little inventory and no clear indication of when more inventory will come.

Of all my sales this year in Southern California nearly all of them have been from “must sell” situations involving death, disability, divorce, relocation for jobs, or investors selling their CA investments. The family that needs a bigger home that would normally sell and buy are hunkering down because they are now married to their rate, even if the home isn’t great.

I believe this is the new normal for the next few years unless something dramatic happens and we fall into a huge recession. Signs of that happening are on the distant horizon but it’s too early for me to tell.

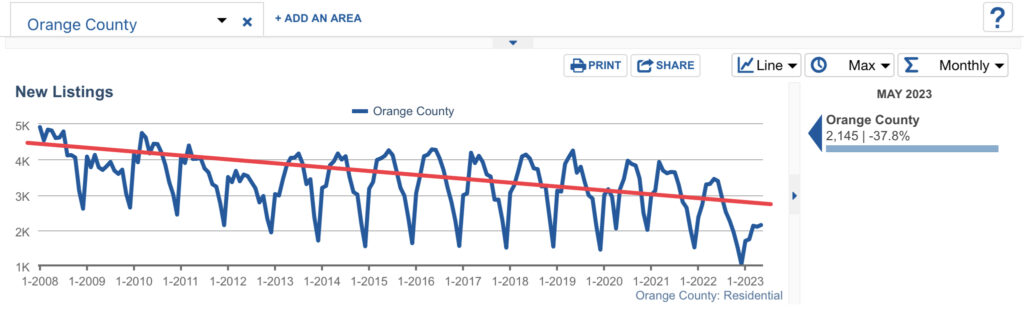

No New Listings (okay a few, but not a lot)

Here’s a chart from the California Regional MLS showing the number of new listings in Orange County going back to 2008. You can see the number of new listings has been declining (I added the red line) . In May we saw a year-over-year decline of roughly 38%. More importantly the number of new listings in May 2023 is the lowest number of new May listings on the entire timeline.

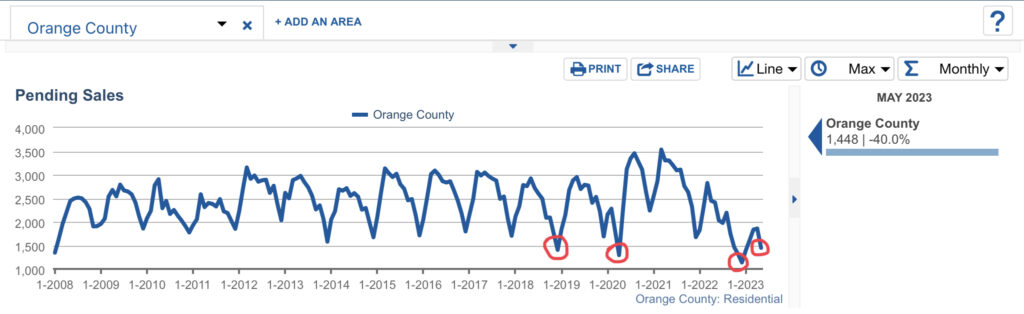

Pending sales since 2008 have seen wider swings between the highs and lows, but four times since 2018 we’ve seen pending sales drop below 1,500 in any given month.

In the chart below, I have marked four places where the pending sales dipped to record lows. The first circle was December 2018 and I didn’t do any research to look into that one. The second circle is April 2020 in the middle of the nationwide shutdown and is an anomaly. The third circle is December 2022 and is a direct reflection of the rapidly rising interest rates in the 4th Quarter of 2022. Buyers, shocked but the rising rates backed off.

What is happening in May of 2023? In may we see a decline of 40% form the previous year. What is happening? The answer is simple, with fewer listings there are fewer sales.

With fewer sales I expect to see an overall decline in the Southern California economy. Fewer home sales means less earnings for Realtors and Lenders, fewer trips to Home Depot and Lowe’s, etc. Real Estate sales fuel a significant portion of the economy here in SoCal and we are already seeing the effects.

Realtors and Lenders need to tighten up their budgets and trim expenses.

Homeowners looking to move can get a premium right now as buyers fight over the few homes that are available. We recently had two listings that received 20 offers each.

Homebuyers need to sharpen their pencil, work with lenders and Realtors that have a track record of success and be aggressive if they want to get the home they love because with fewer options, home prices are climbing.

The market is moving but we simply don’t have the same number of sales as we used to.

How long will it last?

The best I can figure right now is that we will see this pattern for the next few years until the buyers who are buying today at higher interest rates are ready to sell and move. Because they are buying with higher interest rates, when they go to sell they won’t have the same “rate” sticker shock that the rest of us have.

Data from California Regional Multiple Listing Service as of 6/14/2023.

https://crmls.stats.10kresearch.com/infoserv/s-v1/52G4-Tbn

Used with permission.